Adjusted gross income calculator hourly

Sally is able to claim a total of 4000 of income adjustments. 60000 1800 5000.

Calculating Income Hourly Wage Youtube

Step 4 Click calculate.

. - In case the pay rate is hourly. Gross income includes your wages dividends capital gains business income retirement distributions as well as other income. Now that you have your total annual income and the total amount of your deductions subtract your deductions from.

A Hourly wage is the value specified by the user within GP. She subtracts 4000 from 66800 to find her adjusted gross income which is 62800. Step 1 Select your filing status.

The first step in computing your AGI is to determine your total gross income for the year which includes your salary in addition to any earnings from self. Thats the median individual income for a person who typically worked 40 or more hours per week. Doing agi calculation by using adjusted gross income formula.

How to find adjusted gross income on tax return. Adjustments to Income include such items as. First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401k.

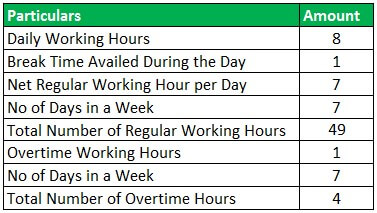

Adjusted gross income is your gross income minus your adjustments. Lets say that your hourly wage is 15 and you work eight hours per day from Monday to Friday. With five working days in a week this means that you are working 40 hours per week.

How To Calculate Adjusted Gross Income. How to use the AGI calculator. Step 2 Enter all eligible income.

B Daily wage GP WPD C Weekly wage GP WPD WDW D Monthly wage E 12 E. How to calculate adjusted gross income. Your gross income includes your wages.

Subtract your deductions from your total annual income. A good income in the United States started around 54151 in 2021. Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be.

Gross income does not include gifts and inheritances tax-free Social Security benefits and tax-free interest from state or local bonds. Step 3 Input all eligible deductions. You can locate your federal gross wages on your W-2 form.

AGI Gross Income Adjustments To Income. To calculate your AGI start with your gross income and subtract all eligible above-the-line deductions. First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401k.

A better income is. 2 Deduct the following items.

Annual Income Calculator

Top 6 Best Annual Salary Income Calculators 2017 Ranking Yearly Income Calculator To Calculate Annual Salary Advisoryhq

4 Ways To Calculate Annual Salary Wikihow

Agi Calculator Adjusted Gross Income Calculator

3 Ways To Calculate Your Hourly Rate Wikihow

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Hourly Rate Calculator

Hourly Paycheck Calculator Step By Step With Examples

What Is Gross Pay Definition Examples Calculation

Annual Income Formula And Gross Earnings Calculator Excel Template

Hourly To Annual Salary Calculator How Much Do I Make A Year

Calculators Annual Salary Calculator Billable Hours Head Hour Rate

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Cqfqljckmbjxgm

Hourly Paycheck Calculator Step By Step With Examples

How To Calculate Gross Income Per Month